Description

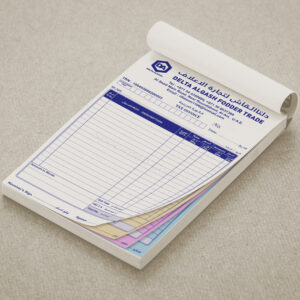

Tax Invoice Book

Quantity: 1 original copy + 1 duplicate copy

Printing: One-color printing (typically in black ink)

Size: A4

Description:

A tax invoice book is a critical tool for businesses to document sales transactions and provide customers with a record of their purchases. Here’s a breakdown of each element in the description:

- Original Copy: The original copy is the top sheet of the invoice book, typically printed on white or light-colored paper. It is given to the customer as proof of their purchase. The original copy contains all essential transaction details, including the seller’s information, buyer’s details, an itemized list of products or services, prices, applicable taxes, and the total amount due.

- Duplicate Copy: There is one duplicate copy included with this invoice book. The duplicate copy is often created using carbon or carbonless paper. It is retained by the seller for record-keeping purposes. This copy ensures that the seller has a record of the transaction for accounting and tax purposes.

- One-Color Printing: The invoice is printed using a single color, typically black ink. This keeps the printing cost efficient and is standard for most invoice books.

- A4 Size: A4 is a standard paper size measuring 21×29.7 cm (approximately 8.3×11.7 inches). It provides ample space for detailed information and is a commonly used size for invoices and other business documents.

This tax invoice book is designed to help businesses maintain organized records of their sales, streamline accounting processes, and adhere to tax regulations by providing customers with a proper invoice for their purchases. It serves as a crucial document for both the business and its customers, offering evidence of the transaction and payment. The use of one-color printing helps keep costs down, and the A4 size allows for comprehensive information to be included on each invoice.

Reviews

There are no reviews yet.