Description

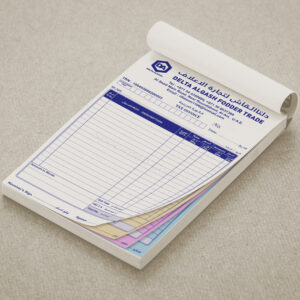

Tax Invoice Book

Quantity: 1 original copy + 3 duplicate copies

Printing: One-color printing (typically in black ink)

Size: A5 (14×21 cm)

Description:

A tax invoice book is a critical tool for businesses to document sales transactions and provide customers with a record of their purchases. Here’s a breakdown of each element in the description:

- Original Copy: The original copy is the top sheet of the invoice book, usually printed on white or light-colored paper. It is given to the customer as proof of their purchase. The original copy contains all essential transaction details, including the seller’s information, buyer’s details, an itemized list of products or services, prices, applicable taxes, and the total amount due.

- Duplicate Copies (3): This invoice book includes three duplicate copies for each transaction. These duplicate copies are commonly made using carbon or carbonless paper. They are retained by the seller for record-keeping purposes. Having three duplicate copies ensures that both the business and the customer, as well as any additional parties, have a record of the transaction.

- One-Color Printing: The invoice is printed using a single color, typically black ink. This is a cost-effective and standard practice for most invoice books.

- A5 (14×21 cm): A5 is a standard paper size measuring 14×21 cm (approximately 5.5×8.3 inches). Its compact size is convenient for maintaining records and handing out to customers.

This tax invoice book is designed to help businesses maintain well-organized records of their sales, simplify accounting processes, and adhere to tax regulations by providing customers with a proper invoice for their purchases. It serves as a crucial document for both the business and its customers, offering evidence of the transaction and payment. Additionally, the inclusion of three duplicate copies ensures that multiple parties can keep a record of the transaction for their respective needs.

Reviews

There are no reviews yet.